ABOUT US

With over a decade of experience, Citadel Gold has helped thousands of Americans protect their savings through physical gold and silver. Our team is made up of industry veterans, knowledgeable financial educators, and real people who genuinely care about your financial future.

At Citadel Gold, we don't just sell metals—we build long-term relationships rooted in trust, integrity, and transparency.

About Citadel Gold

A Heritage of

Trust & Excellence

For over two decades, Citadel Gold has served as a trusted steward for investors who value stability, discretion, and the enduring protection of tangible assets.

IRS-Approved Custody

Fully compliant depositories

Insured Storage

Delaware Depository vault

Personalized Guidance

Dedicated account specialists

Transparent Pricing

Clear, straightforward fees

Stability you can hold. Strength you can trust.

Elevate your portfolio with the stability of gold and silver.

Protect Your Retirement.

Enjoy the Life You Earned.

You've worked a lifetime to build your future. Now it's time to protect it. At Citadel Gold, we help safeguard your wealth with tangible assets designed to bring stability, confidence, and peace of mind — so you can focus on living well, not worrying about what's next.

The Citadel Difference

Why Discerning Investors Choose Us

Clear, Transparent Pricing

Every transaction is quoted with full visibility — no hidden fees, no ambiguity. You see exactly what you pay and what you own.

Guaranteed Liquidity

When the time comes to sell, Citadel Gold offers a straightforward buyback program — ensuring your metals remain a liquid, accessible asset.

Institutional-Grade Pricing

Our long-standing relationships with leading mints and refineries allow us to offer pricing typically reserved for institutional buyers.

Dedicated White-Glove Service

Every client is paired with a personal advisor who provides guidance from first conversation through long-term portfolio management.

Own Precious Metals Directly

Beyond Retirement Accounts — Personal Ownership, Fully Allocated

Not every investment belongs inside a retirement account. For clients seeking direct control over their holdings, Citadel Gold offers fully allocated gold and silver available for secure home delivery or private vault storage.

Whether diversifying outside of traditional markets or establishing a tangible reserve, direct ownership provides complete autonomy — with no custodians, no intermediaries, and no restrictions.

Your metals. Your possession. Your terms.

Real-Time Market Visibility

Current Precious

Metal Prices

Precious metals markets move continuously — and informed timing can meaningfully impact long-term value. Citadel Gold provides clients with access to live spot pricing and market insights, allowing you to monitor conditions alongside your advisor.

Transparency isn't a feature. It's how we operate.

SPOT PRICE

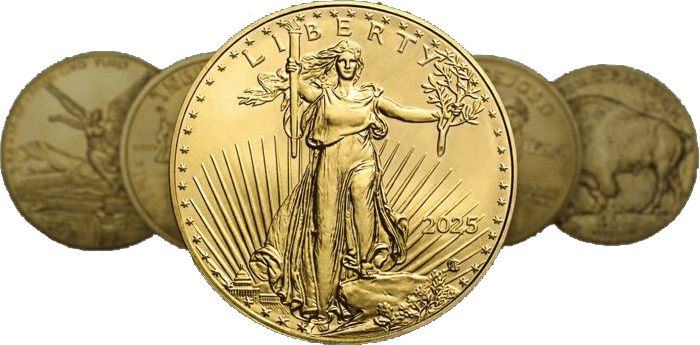

The Case for Precious Metals

Why Invest in Gold & Silver?

Gold and silver have been valued for centuries due to their ability to hold value. Here's why they remain a cornerstone of sound financial strategy.

Hedge Against Inflation

When the cost of living rises, the value of paper currency declines. Gold has historically preserved purchasing power during inflationary periods, helping investors maintain the real value of their wealth over time.

Portfolio Diversification

Precious metals move independently of stocks and bonds. Adding gold and silver to your portfolio reduces overall risk and provides a stabilizing counterweight when traditional markets decline.

Protection from Volatility

When the market fluctuates, gold and silver often maintain or even increase in value. Physical assets provide a tangible layer of stability that paper investments simply cannot match.

Long-Term Store of Value

Gold has maintained its value for thousands of years, outlasting every fiat currency in history. Strong demand, limited supply, and intrinsic worth make it one of the most reliable long-term stores of value available.

Smart investors don't just grow wealth — they protect it.

Begin a Conversation About Your Future

Let us help you explore how precious metals can strengthen and protect your retirement portfolio.